Hinkal V2: A Giant Leap Towards Shared Privacy Ecosystem

With less than a week until the Hinkal V2 release, let's explore the updates, differences from the current framework, and how it enhances transaction privacy.

Current version: key achievements and challenges

With Hinkal V1 we have already accommodated the need for privacy for two major use cases:

- Private on-chain trading strategies (including liquidity provision, taking, and yield trading);

- B2B payments with no on-chain transaction tracing.

Hinkal has processed around $200M in private transactions in 2024 so far, which proves that demand for DeFi privacy is high.

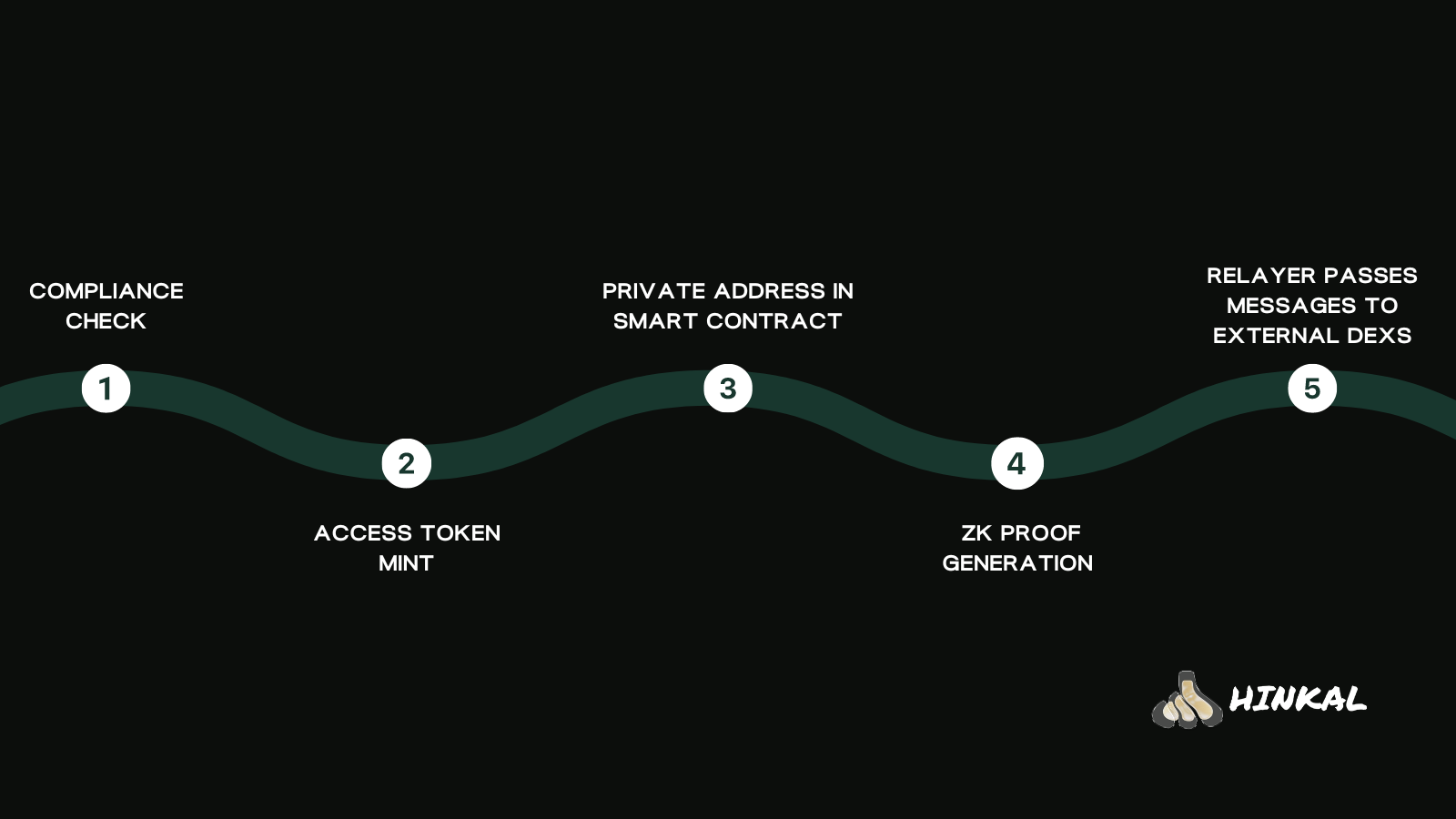

We created a smooth and reliable user flow:

Please read this blog post for a detailed overview of our current privacy solution.

Now let's discuss the main challenges of this framework. There are two points that we should mention. The first issue is scalability:

- Need for separate shielded pools on each L1 and L2;

- High capital and time costs for building privacy pools.

The second issue is the contribution incentive problem or lack of thereof, leading to opportunism. A quick example: Jane deposited 100 ETH, and John deposited 1 ETH. What is the issue here? Jane provided anonymity for John, but he didn't provide anonymity for her. This is a classic public good provision problem that liquidity providers are facing.

Hinkal V2 To Solve These Issues

Next week we are launching version 2 of Hinkal dApp which will reflect a new Shared Privacy vision. What are the core features?

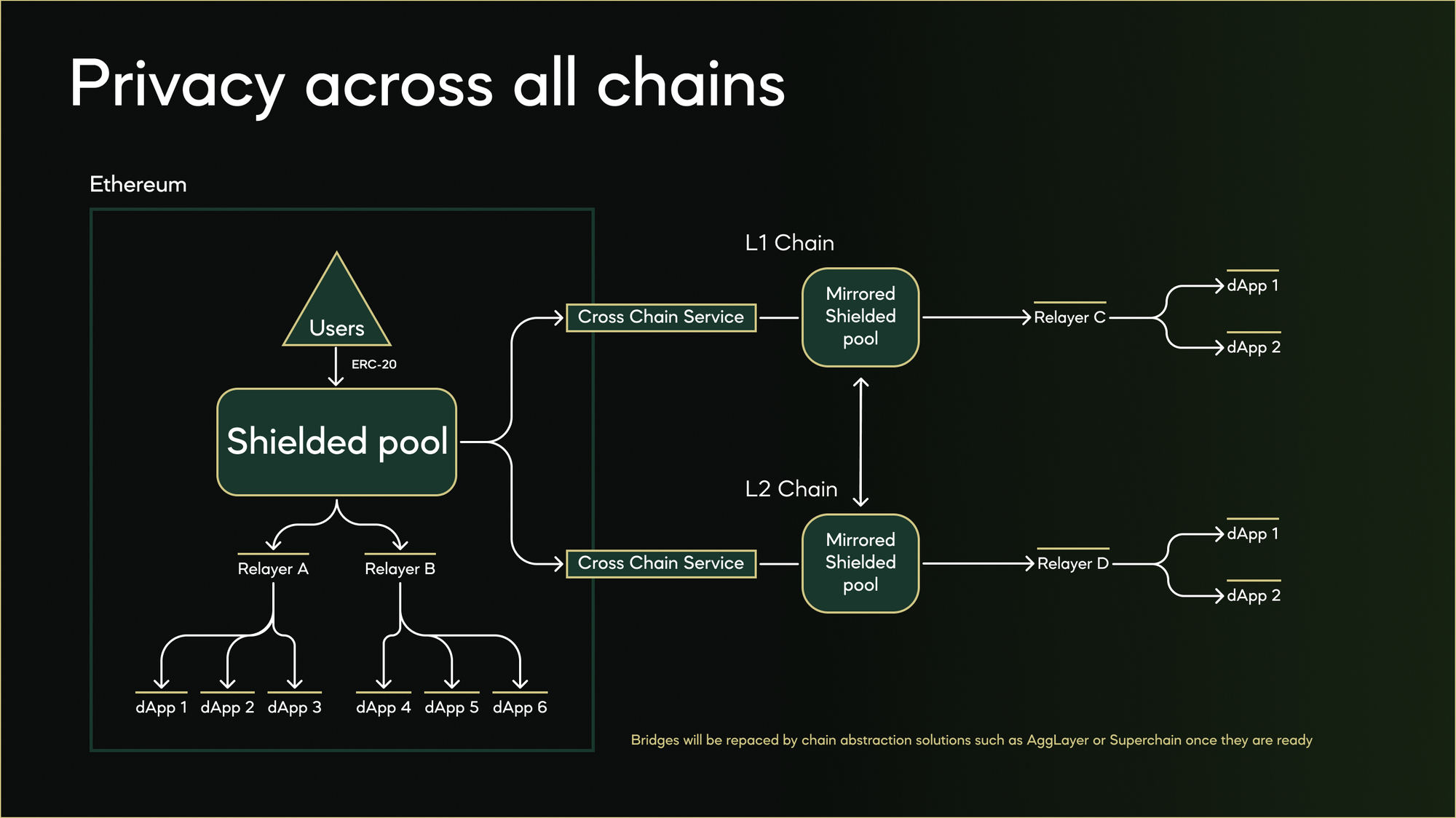

The first novelty will be the Mirrored Shielded Pools:

- Main high-liquidity privacy pool on Ethereum mainnet

- Users privately transfer to L1s and L2s, inheriting mainnet's anonymity set

- Solves bootstrapping issues for new chains

With the Shared Privacy Ecosystem, we also introduce new roles: the first of them is Stakers.

- They rent out privacy without needing it themselves

- Receive yield-bearing receipt tokens (we will discuss Staking and hTokens in more detail in our next blog post)

- Yield from user transaction fees (private swaps, liquidity provision)

The second ecosystem role that goes live is Curators. Influential entities and trading firms such as Re7 Labs, Dialectic, Aquanow, Theia, and Agnostic are supporting the Shared Privacy vision to facilitate dApp integrations and, therefore, grow Hinkal's ecosystem.

There are also staking delegates: we have recently partnered with Everstake and Simply Staking - two world's largest staking providers. By adding Staking Delegates we offer a new yield source to operators, and they help us grow the anonymity pool.

And finally, various dApps will be joining Hinkal's Shared Privacy ecosystem. What dApps can do:

- Integrate Hinkal via modular SDK

- Get shared fees and revenues

Cross-Chain Private Transactions

This will be the main value that we enable for Hinkal's users next week. Historically, providing privacy on multiple chains implied bootstrapping an individual anonymity set on each chain. With Ethereum privacy across all chains, Hinkal solves this problem and makes privacy scalable.

Using cross-chain services and bridges, Hinkal can leverage the largest anonymity set (Ethereum) and share it among other chains. If this is not a privacy revolution in DeFi - then we don't know what is!

Follow our social media to get more daily updates on the upcoming release!